If you are injured in an accident that was caused by another party acting negligently or recklessly, and you missed work as a result, then you might be eligible to recover damages for your lost wages. But what happens if you are self-employed and do not have a straightforward “wage?” While this can be complex, a good personal injury attorney can help you prove your lost wages. Read on to learn more or contact Law Offices of Michael A. Kahn at (310) 209-1600 for a free legal consultation.

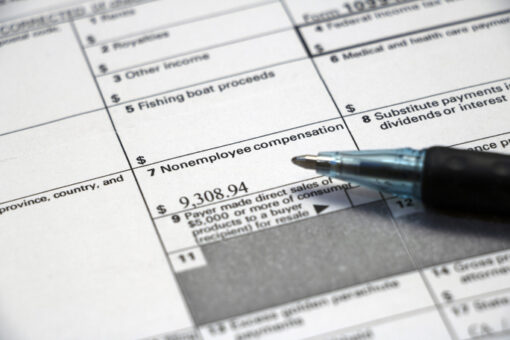

A Form 1099-MISC Can Make it Much Easier

If you are self-employed, but you do work for another company as an independent contractor, it can be much easier to calculate lost earnings than in other situations. A Form 1099-MISC is generally issued to an independent contractor from their “employer.”

Yearly Averages Are Used

It is often the case that a person who is self-employed might earn a bulk of their income during certain months of the year and earn much less in other months. For example, a person who lives in Minnesota doing snow removal would not be earning much for most months of the year. The good news for those who are injured during slow times is that a yearly income average is used – not how much is lost in a given month. Of course, this can be bad news if a person is unable to work during their busiest months of the year.

Tax Returns Can Be Used but It Can Be Complicated

Many would just assume that a self-employed person would simply use their tax records to show how much they have made in previous years. However, this can be tough. Why? Because, for many different reasons, they might not want their federal and state income taxes to become part of the public record. California law is clear that no plaintiff can be required to provide federal or state tax returns (unless they are directly related to matters of tax law).

Different Complications Exist for Small Business Owners

If you are a person who is self-employed, you might not have any way of proving income other than tax returns. However, if you have receipts, along with evidence of what is in your profit and loss statements, you might be able to prove lost wages without having to disclose your entire tax return.

The Key is Finding the Right Attorney

At the end of the day, you do not have to worry about any of this – your personal injury attorney can guide you based on your specific situation. If you are ready for a free legal consultation, contact Law Offices of Michael A. Kahn at (310) 209-1600 today.